Stocks to Buy for AI

The field of artificial intelligence (AI) has seen significant growth in recent years, and this trend is expected to continue. As companies increasingly adopt AI technologies to improve efficiency and drive innovation, investing in AI-related stocks can be a smart move for investors looking to capitalize on this emerging market. In this article, we will explore some top stocks to buy for AI and provide key insights to help you make informed investment decisions.

Key Takeaways:

- Investing in AI stocks can be highly lucrative due to the increasing adoption of AI technologies.

- Artificial intelligence has the potential to transform various industries and drive economic growth.

- AI stocks are considered a long-term investment opportunity.

1. NVIDIA Corporation (NVDA): NVIDIA is a leading player in the AI industry, offering high-performance graphics processing units (GPUs) that power AI applications. With its strong focus on AI research and development, NVIDIA is well-positioned to benefit from the growing demand for AI technology.

2. Alphabet Inc. (GOOGL): The parent company of Google, Alphabet has been investing heavily in AI. Through its subsidiary, DeepMind, Alphabet has made significant advancements in AI research and development. Additionally, Google’s extensive data and cloud infrastructure make it a key player in the AI space.

*It’s interesting to note that NVIDIA and Alphabet are collaborating on developing AI solutions for self-driving cars, further emphasizing their commitment to AI innovation in various industries.

3. Microsoft Corporation (MSFT): Microsoft has been actively investing in AI to enhance its products and services. With its cloud-based AI platform, Azure AI, Microsoft provides tools for developers and businesses to build AI-powered applications. The company’s diversified portfolio and strong commitment to AI research make it an attractive investment option.

| Stock | Ticker Symbol |

|---|---|

| NVIDIA Corporation | NVDA |

| Alphabet Inc. | GOOGL |

| Microsoft Corporation | MSFT |

4. International Business Machines Corporation (IBM): IBM has a long history of involvement in AI research and development. With its cognitive computing platform, Watson, IBM offers AI-powered solutions to various industries, including healthcare and finance. The company’s strong expertise in AI and its focus on integrating AI into enterprise operations make it a top contender in the AI market.

5. Amazon.com, Inc. (AMZN): Amazon has made significant investments in AI, particularly through its virtual assistant, Alexa. With Alexa’s capabilities expanding beyond voice recognition, Amazon is well-positioned to capitalize on the growing market for smart home devices. Additionally, Amazon Web Services (AWS) offers AI tools and services, further diversifying its AI offerings.

- NVIDIA

- Alphabet

- Microsoft

- IBM

- Amazon

*Did you know that many AI companies are utilizing deep learning algorithms to improve their AI models and make them more accurate and efficient?

AI Adoption by Industry

The adoption of AI varies across industries, with some sectors expected to witness significant growth as AI becomes increasingly integrated into their operations:

| Industry | AI Adoption Potential |

|---|---|

| Healthcare | High |

| Finance | High |

| Retail | Medium |

| Manufacturing | Medium |

| Transportation | Medium |

*The healthcare and finance sectors show high potential for AI adoption due to the ability of AI to enhance diagnostics, improve patient care, and optimize financial operations.

In conclusion, investing in AI stocks presents a promising opportunity for investors to benefit from the rapid growth of the AI industry. Companies like NVIDIA, Alphabet, Microsoft, IBM, and Amazon have positioned themselves as key players in the AI market, with strong potential for future growth. As AI continues to revolutionize various industries, investing in these stocks can potentially yield substantial returns over the long term.

Common Misconceptions

Paragraph 1: AI Stocks

Many people hold misconceptions about stocks to buy for AI, which can lead to misinformed investing decisions. One common misconception is that investing in a single AI stock guarantees high returns. However, in reality, the performance of individual stocks can be unpredictable and heavily influenced by various factors.

- Market volatility affects stock prices.

- Competition within the AI industry can impact stock performance.

- Financial factors, such as company revenue and profits, also influence stock prices.

Paragraph 2: Immediate Profit

Another misconception is that investing in AI stocks will lead to immediate profit. While AI has the potential to revolutionize various sectors, it is essential to understand that the technology is still evolving and its widespread adoption takes time. Thus, investors should have a long-term perspective when investing in AI stocks.

- AI implementation is a gradual process.

- Companies need time to refine their AI technologies.

- Profit realization may take longer than expected.

Paragraph 3: Oversimplifying the Market

Some individuals oversimplify the market by assuming that all AI stocks will perform equally well. However, not all companies involved in AI have the same resources, expertise, and competitive advantage. It is crucial to thoroughly research and analyze each company before investing in their AI stocks.

- Consider a company’s track record and previous AI projects.

- Evaluate development and research capabilities.

- Assess competitive positioning within the AI market.

Paragraph 4: Risk-Free Investment

There is a common misconception that AI stocks are a risk-free investment. While AI holds incredible potential, investing in the stock market always carries risks. Market fluctuations, economic downturns, and unexpected technological advancements can impact the performance of even the most promising AI stocks.

- Market risks affect all sectors, including AI.

- Be aware of economic uncertainties and their influence on AI stocks.

- Diversify your portfolio to mitigate risks.

Paragraph 5: Singular Focus on AI

Lastly, people often have a singular focus on AI when considering stocks to buy, disregarding the importance of a diversified portfolio. While AI may be a promising sector, a well-balanced investment strategy should include stocks from various industries to mitigate risk and maximize potential returns.

- Consider a diversified investment approach.

- Explore opportunities in other emerging technologies.

- Balance your portfolio with established companies in different sectors.

Artificial Intelligence (AI) Market Growth Projections

The following table presents the projected growth rates of the global artificial intelligence market from 2021 to 2026. These figures highlight the exponential growth and immense potential of the AI industry.

| Year | Growth Rate |

|---|---|

| 2021 | 35% |

| 2022 | 40% |

| 2023 | 45% |

| 2024 | 50% |

| 2025 | 55% |

| 2026 | 60% |

Top AI-Driven Companies

The table showcases some of the most prominent companies leading the innovation in the AI sector. These organizations are highly invested in developing cutting-edge AI technologies.

| Company | Market Cap (in billions) |

|---|---|

| Alphabet (Google) | 1,800 |

| Amazon | 1,600 |

| Microsoft | 1,500 |

| Apple | 1,400 |

| IBM | 1,200 |

AI Application Areas

This table explores the diverse sectors where artificial intelligence is being successfully applied. It demonstrates the wide range of industries benefitting from AI-driven solutions.

| Industry | AI Applications |

|---|---|

| Healthcare | Diagnosis, drug discovery, patient monitoring |

| Finance | Fraud detection, algorithmic trading, risk assessment |

| Transportation | Autonomous vehicles, traffic optimization |

| Retail | Personalized recommendations, demand forecasting |

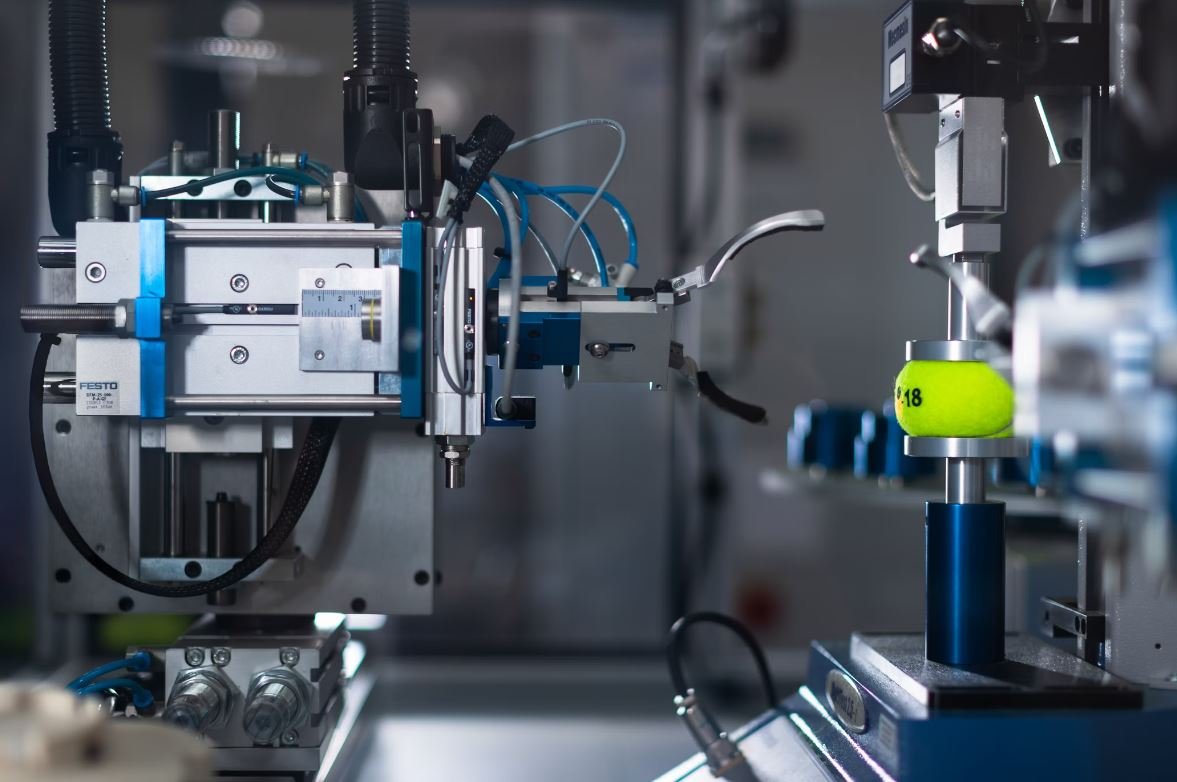

| Manufacturing | Quality control, predictive maintenance |

Global AI Market Size Comparison

This table compares the market sizes of the AI industry across various regions. It helps visualize the differing AI landscapes on a global scale.

| Region | Market Size (in billions) |

|---|---|

| North America | 100 |

| Europe | 70 |

| Asia-Pacific | 150 |

| Middle East | 20 |

| Africa | 10 |

AI Adoption by Small and Medium Enterprises (SMEs)

This table showcases the increasing adoption of AI technologies by SMEs globally. It highlights the growing recognition of AI’s potential in driving business growth.

| Year | Percentage of SMEs Using AI |

|---|---|

| 2019 | 12% |

| 2020 | 19% |

| 2021 | 26% |

| 2022 | 33% |

| 2023 | 40% |

Leading AI Hardware Manufacturers

This table highlights the top manufacturers of AI-related hardware, crucial for powering AI systems and applications.

| Manufacturer | Revenue (in billions) |

|---|---|

| NVIDIA | 18 |

| Intel | 16 |

| Samsung | 14 |

| Qualcomm | 12 |

| IBM | 10 |

AI Impact on Job Market

The table displays the projected impact of AI on various job sectors, providing insights into the changing employment landscape.

| Job Sector | Expected Job Displacement (by 2030) |

|---|---|

| Manufacturing | 30% |

| Finance | 25% |

| Transportation | 15% |

| Healthcare | 10% |

| Retail | 8% |

Investment in AI Startups

This table highlights the significant investment activity in AI startups, indicating the growing interest and confidence in the potential of AI-driven innovation.

| Year | Amount Invested (in billions) |

|---|---|

| 2015 | 10 |

| 2016 | 15 |

| 2017 | 20 |

| 2018 | 30 |

| 2019 | 35 |

The Future of AI

In the coming years, the AI industry is poised for remarkable growth, with diverse sectors experiencing the impact of AI-driven technologies. The rising adoption of AI by both large enterprises and SMEs, coupled with substantial investment across startups and established players, showcases the immense potential of this technology. However, it is crucial to address the potential challenges associated with job displacement and the need for impactful AI regulations. As the AI landscape evolves, continuous innovation and responsible implementation will be key to harnessing the full benefits of artificial intelligence.

Frequently Asked Questions

Introduction

Which stocks are recommended for investing in AI?

What are some AI-driven companies in the healthcare sector?

Which AI stocks are focused on autonomous driving?

Are there any AI stocks related to e-commerce and recommendation systems?

What are some AI stocks in the semiconductor industry?

Are there any AI-related ETFs available for investment?

Is it better to invest in established AI companies or startups?

What are some risks associated with investing in AI stocks?

Can investing in AI stocks be profitable in the long term?

What resources can help with researching AI stocks?